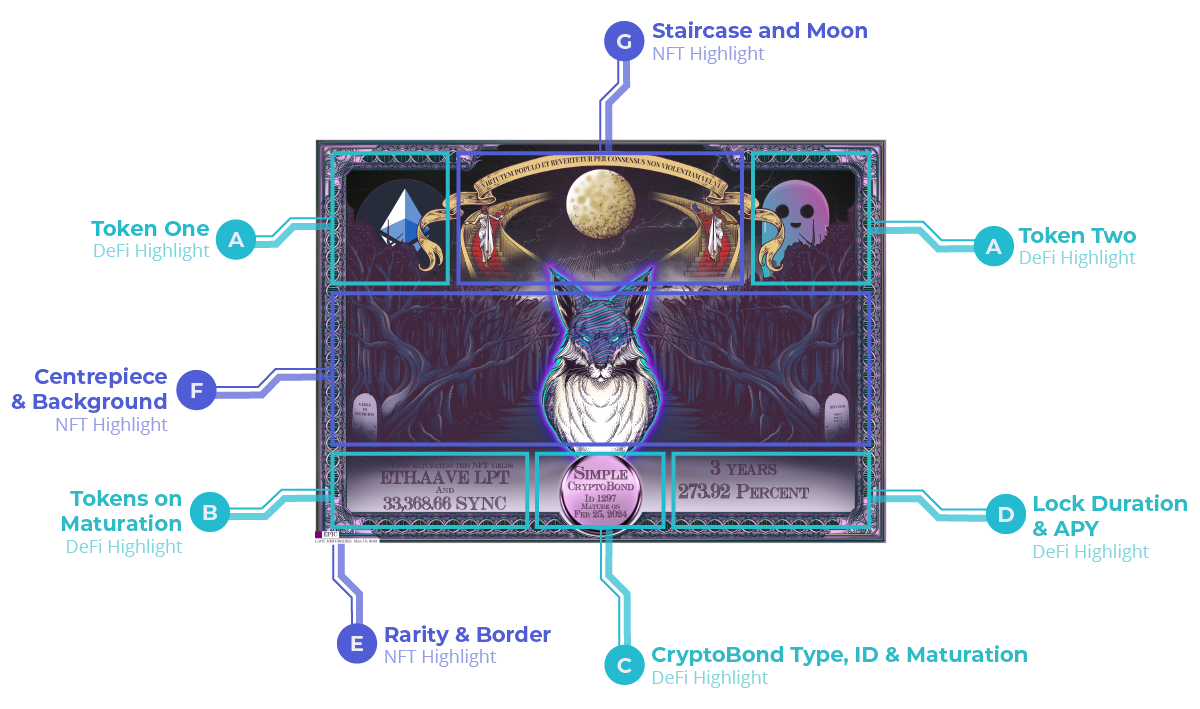

DeFi Highlights

Token Pair (A)

This part displays the token pair which the LPTs represent. Upon maturity, you can visit Uniswap and exchange the LPTs for these tokens plus the acquired Uniswap fees. You could also keep the LPTs and continue to earn 0.3% Uniswap fees for providing liquidity.

Tokens on Maturation (B)

Here you can see which LPTs you’ll get and how many SYNC tokens in total (initial + rewards) upon maturity. Once the CryptoBond has reached its maturation date, you can collect the containing tokens, which will burn the NFT. By collecting, you’ll receive UNI-V2 LPTs + 0.3% Uniswap fees, the initial amount of SYNC, plus the generated SYNC rewards.

CryptoBond Type, ID and Maturation (C)

This part shows you the CryptoBond’s ID, it’s maturation date and the type. The type will either be a simple or periodic CryptoBond. IDs ending on 77 are called lucky and provide higher rewards rates. When trading CryptoBonds on NFT markets like Rarible or OpenSea, be sure to check the ID.

Lock Duration (D)

Here you can see how long the CryptoBond is locked. The longer you lock, the higher the rewards. You can choose between 90 days, 180 days, 1 year, 2 years or 3 years. Optionally you can select if you want a simple or periodic CryptoBond. The periodic one pays rewards quarterly at a lower rate than the simple Cryptobond.

APY (D)

This number displays the additional SYNC rewards in percentage added to the initially deposited amount when the CryptoBond was created. The SYNC token amount on the left side is already transparently exposing the total (initial + rewards). The reward rates readjust daily based on the given token pairs market supply and demand.